by L. Lynne Kiesling

Ronald Coase (1910-2013) was one of the most influential economists of the 20th century. His influence is due largely to two publications, the only two cited in the announcement of his Nobel Prize: “The Nature of the Firm” (1937) and “The Problem of Social Cost” (1960). These two articles are among the most-cited works in economics. The ideas Coase developed in these two works led to entirely new fields of inquiry in economics, law, management, and political science, and in conjunction with his article on using markets to allocate radio spectrum (Coase 1959), spawned new market design theory and practice that helped to transform our society and enable innovation and digitization.

Coase’s style of theory, analysis, and persuasion was narrative, fact-driven, and much less formal than is the norm in economics. Coase spent his career asking deceptively simple questions that revealed profound complexities in the arrangement of economic activity. Why do firms exist? Why don’t we allocate scarce resources such as radio spectrum by using markets instead of regulation? Can people resolve conflicts over resource use through bargaining and contracts, or is government regulation necessary? Is a lighthouse a public good that requires government provision? How does a durable goods monopolist price its output?

Ronald Harry Coase was born in Willesden, a London suburb, on December 29, 1910. While attending the University of London, from which he graduated with a Bachelor of Commerce degree in 1932, Coase was awarded the Sir Ernest Cassell Travelling Scholarship. This scholarship enabled him to travel to the United States, study at the University of Chicago from 1931 to 1932 with Frank Knight and Jacob Viner, and visit several factories to learn how they organized production. In particular, his visits to Ford and General Motors factories provided an empirical foundation for his first paper, “The Nature of the Firm” (1937). He initially taught in the UK, and then his academic career saw him migrate to the US. After some years at the University of Virginia, he spent most of his career on the law faculty at the University of Chicago (starting in 1964), where he also served as an editor of the Journal of Law and Economics.

He was awarded the Nobel Prize in economics in 1991 “for his discovery and clarification of the significance of transaction costs and property rights for the institutional structure and functioning of the economy.”

Coase was consistently critical of what he called a “blackboard economics” approach to economic theory that focuses on optimization models with defined constraints, not on the actual structures of interactions and relationships that underlie economic activity. In many ways Coase found this to be empty theorizing because it overlooked precisely what is economic—the diverse ways people organize production and economic activity for mutual benefit.

Coase wrote and worked until his death on September 2, 2013.

Listen In

Listen to the Essential Scholars Explained podcast with host Rosemarie Fike in conversation with the author, Dr. Lynne Kiesling to discuss the work, life, and ideas of Ronald Coase.

Ronald Coase Part 1: Reconciling Theory with Reality

Dr. Lynne Kiesling, author of The Essential Ronald Coase, joins host Rosemarie Fike to discuss Ronald Coase, one of the most influential economic thinkers of the 20th century, including his dissection of Price Theory in favour of real market evidence and tenure at the University of Chicago Law School that eventually lead to his Nobel Prize.

Ronald Coase Part 2: Markets Don’t Fail, They Fail to Exist

Dr. Lynne Kiesling, author of The Essential Ronald Coase, once again joins host Rosemarie Fike to discuss Ronald Coase, specifically his theory of markets and what exactly prevents them from naturally emerging.

Download the Book

Get a digital copy of the book. Choose the version you prefer below.

Explore the Book

Chapter by chapter summary of the book.

-

Chapter 1

Institutions, Property Rights, and Transaction Costs

In all of his work Coase emphasized the importance of incorporating institutions into economic theory and empirical economic research. Institutions are the arrangements, the “rules of the game,” that structure social interactions. They vary from informal social norms about acceptable conduct to formal law enshrined in precedent or legislation. Institutions structure social interactions in the sense that they shape the incentives that individuals face as they make decisions, decisions that can affect their own outcomes and the outcomes for other people.

-

Chapter 2

Why Do Firms Exist?

In response to the question “why do firms exist?” Coase answered that they exist in order to address—specifically, to keep to a minimum—transaction costs. Coase’s answer unleashed a stream of influential research that is still generating new ideas today (although he did not use that phrase in his 1937 article, calling them “marketing costs” instead). Coase defined transaction costs as “the cost of using the price system” (1937: 390). A more general definition is the cost of establishing and maintaining property rights (Allen 1999:898). As examples of transaction costs, Coase included the task of discovering what market prices are and the cost of negotiating a separate contract for each transaction. Institutions emerge to reduce those costs, but they can never be eliminated entirely.

-

Chapter 3

Resolving Disputes: The Problem of Social Cost

How can people resolve conflicts over resource use when that use creates costs for people who are not party to the transaction? Coase used his approach of examining how people resolve such conflicts in reality to look at the history of how disputes were resolved in English common law, from grazing cattle eating a neighbouring farmer’s crops to industrial smoke harming nearby residents.

-

Chapter 4

Applied Transaction Cost Economics: Spectrum Allocation

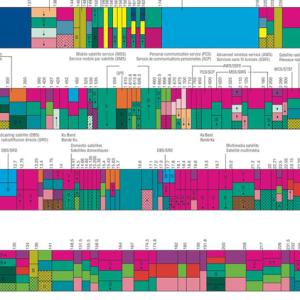

In 1959 Coase published “The Federal Communications Commission,” an article that explained the institutional and historical background of the development and use of radio spectrum in the United States since the 1910s. Coase asked if there was a feasible way to allocate the use of radio spectrum to create the most possible value out of it, which the then-current public interest hearings method did not accomplish. The policy objective should be not to minimize interference along the spectrum, but to maximize output from the spectrum, treating interference as a constraint to be managed (or something that innovation would reduce). Why not define a property right in a specific part of the spectrum for each user, and make those rights tradable? Coase here followed the suggestion of Leo Herzel (1951), who proposed defining spectrum ownership rights and allocating them through auctions.

-

Chapter 5

Applied Transaction Cost Economics: Emission Permit Trading

Transaction costs, that is, the costs of defining property rights, shape incentives and how we organize the use of resources. As the example in the previous chapter of spectrum license auctions shows, these ideas have significant policy implications, even if their implementation takes decades. The use of emission permit trading in the United States to reduce air pollution is another example; it too, has long-lasting and great beneficial effects. The design of the emission permit trading program has several Coasean features, particularly the emphasis on institutional design to reduce transaction costs.

-

Chapter 6

Coase and the Lighthouse in Economics

Since the 19th century economists have routinely posed the lighthouse as an example of a public good. Ships coming in to port benefit from lighthouse services. Ships cannot individually be excluded from using the lighthouse if they have not paid for it, so the public good argument suggests that ships will free-ride on the payments of others for the provision of the lighthouse. If the free-rider problem is extreme, then there won’t be enough lighthouses, or any at all. For that reason, economists starting with John Stuart Mill in 1848 and most notably Paul Samuelson, who formalized public good theory in 1954, concluded that public goods should be supplied by governments and paid for through taxation. Coase was dissatisfied with this treatment of public goods, and in “The Lighthouse in Economics” (1974) he laid out his critique and an alternative analysis.

-

Chapter 7

Problems of Monopoly

An interesting and thorny question in the economic organization of production is monopoly, that is, when a single firm produces all output sold in a market. Coase analyzed two different monopoly questions: how should public utilities price their output, and how should a monopolist that produces a durable good price it?

-

Chapter 8

Conclusion

Coase’s pioneering work brought institutions, property rights, and transaction costs into economic analysis, catalyzing new research in diverse fields in economics, management, law, political science, and other social sciences. The fields of law and economics, property rights economics, transaction cost economics, and institutional and organizational economics built upon Coase’s original contributions to our understanding of the organizational structure of production and the effect of law on economic activity. Founded in 2000, the Ronald Coase Institute works to promote institutional and transaction cost scholarship, particularly by connecting young international scholars and providing them with valuable research opportunities. Similarly, the annual Institutional and Organizational Economics Academy brings together European graduate students working in the Coasean tradition. Through such efforts, research and application in institutional, organizational, and transaction cost economics continues to expand and thrive.

About the Author

Lynne Kiesling

Lynne Kiesling is a Research Professor and Co-Director of the Institute for Regulatory Law & Economics in the College of Engineering, Design and Computing at the University of Colorado-Denver. She also provides advisory and analytical services as the President of Knowledge Problem LLC. Her research in grid modernization and transactive energy uses institutional and transaction cost economics to examine regulation, market design, and technology in the development of retail markets, products, and services, and the economics of smart grid technologies in the electricity industry. She served as a member of the National Institute of Standards and Technology’s Smart Grid Advisory Committee, and is an emerita member of the GridWise Architecture Council. Her academic background includes a BS in Economics from Miami University (Ohio) and a PhD in Economics from Northwestern University.

Additional Resources

Listed below are links to other websites to learn more about Ronald Coase, his theories, written works, lectures, and interviews.

Listed below are links to other websites to learn more about Ronald Coase, his theories, written works, lectures, and interviews.

Coase on Externalities, the Firm, and the State of Economics from EconTalk

Nobel Laureate Ronald Coase of the University of Chicago talks with EconTalk host Russ Roberts about his career, the current state of economics, and the Chinese economy. Coase, born in 1910, reflects on his youth, his two great papers, "The Nature of the Firm" and "The Problem of Social Cost". At the end of the conversation he discusses his new book on China, How China Became Capitalist (co-authored with Ning Wang), and the future of the Chinese and world economies.

Boudreaux on Coase from Econ Talk

Don Boudreaux of George Mason University and Cafe Hayek talks with EconTalk host Russ Roberts about the intellectual legacy of Ronald Coase. The conversation centers on Coase's four most important academic articles. Most of the discussion is on two of those articles, "The Nature of the Firm," which continues to influence how economists think of firms and transaction costs, and "The Problem of Social Cost," Coase's pathbreaking work on externalities.

A Conversation with Ronald H. Coase from EconLib

Nobel laureate Ronald H. Coase (1910-2013) was recorded in 2001 in an extended video now available to the public. Coase’s articles, “The Problem of Social Cost” and “The Nature of the Firm” are among the most important and most often cited works in the whole of economic literature. Coase recounts how he tried to encourage “economists and lawyers to write about the way in which actual markets operate, and about how governments actually perform in regulating or undertaking economic activities.”

Interview With Ronald Coase from The Ronald Coase Institute

A transcribed interview of Ronald Coase, with interviewers John Nye of Washington University and Alfredo Bullard and Hugo Eyzaguirre of INDECOPI, Lima, Peru from the Inaugural Conference for the International Society for New Institutional Economics in St. Louis, Missouri, dated September 17, 1997.

The interview covers a wide range of topics from the reason the International Society for New Institutional Economics was founded, due to mainstream economics overemphasizing the formal and abstract aspects of theory at the expense of empirical and institutional research, to Coase’s hopes for the economics profession and the future of economic research.

Speech To ISNIE: The Task Of The Society from The Ronald Coase Institute

This lengthy speech (dated September 17, 1999) is the opening address to the Annual Conference for the International Society of New Institutional Economics in Washington, DC, and summarizes Coase’s hopes for the society, highlighting the importance of staying true to the promise of the economics field inherent in Adam Smith’s work: empirical application over abstract theory, that being the “task of the society” at large in addition to “transforming economics.”

A conversation with Ronald Coase from Y-S Ko on YouTube

A 62-minute-long Liberty Fund video from their “Intellectual Portrait Series” (dated 2001) consists of a brief biographical account of Ronald Coase, his contributions to the field of economics, and a lengthy conversation between Coase and Richard A. Epstein, in which they discuss the field of economics at large with particular focus on Coase’s seminal text The Firm, The Market, and the Law.

//-->

Ronald H. Coase Banquet speech from Nobel Prize.org

A transcription of Ronald Coase’s short speech at the Nobel Banquet on December 10, 1991, and his gratitude for recognition given to the study of the institutional structure of the economy.

Looking for Results: An Interview with Ronald Coase from Reason Magazine

A lengthy interview (dated January 1997) of Ronald Coase, conducted by economist Thomas W. Hazlett, in which Coase discusses rights, resources, and regulation, and his unusual rise to prominence in the field of economics.

Ronald Coase: Centennial Coase Lecture from the University of Chicago on YouTube

The 17th annual Coase Lecture, presented by Ronald Coase, on April 1, 2003, discussing the present and future of law, economics, and their intersection.

Ronald H. Coase 1910-2013 from EconLib

A succinct summary of Coase’s work as an economist, his unconventional rise to prominence, and his enduring legacy for his work on the discovery and clarification of the significance of transaction costs and property rights for the institutional structure and functioning of the economy.

Ronald Coase British-American economist from Britannica.com

A short, encyclopedic entry on the life and legacy of Ronald Coase, from his pioneering work on how transaction costs and property rights impact business and society to his work on institutional economics, which attempts to explain political, legal, and social institutions in economic terms and to understand the role of institutions in fostering and impeding economic growth.

About Ronald Coase from The Ronald Coase Institute

A paragraph-long entry on Coase’s life, time at the LSE, and eventual role in the clarification of the significance of transaction costs and property rights that would win him the Alfred Nobel Memorial Prize in Economic Sciences in 1991.

Ronald H. Coase from Investopedia

An encyclopedic entry on who exactly Ronald Coase was, his pathbreaking contributions economic theory via institutional economics by highlighting the role of transaction costs and economic institutions, and how a consistent and now enduring theme in Coase's work is the failure of abstract, mathematical models to describe the operation of the real-world economy.

Ronald Coase, Nobel Prize-Winning Economist, Dies at 102; CEI Releases Interview Footage From 2004 from the CEI

A 40-minute interview where Coase, interviewed by CEI Founder Fred L. Smith, Jr., explains the nuances of his work, answers questions about market pricing, antitrust, healthcare, and intellectual property.

Why Economics Will Change from The Ronald Coase Institute

A speech from Coase, dated April 4th, 2002 at the University of Missouri, covering the topic of shifting economics, why it ought to change as it inevitably does so, and the profound impact the static character of economics has had on the discipline as the field shifts towards a more futuristic outlook.

Essential Scholars is brought to you by

Fraser Institute

Institute for Economic Affairs

Institute of Public Affairs

Foundation for Economic Education

Acknowledgements

Made possible by generous grants from the Lotte and John Hecht Memorial Foundation, the John Templeton Foundation, and the Peter and Joanne Brown Foundation.